student loan debt relief tax credit application

Web The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the. Web who wish to claim the Student Loan Debt Relief Tax Credit.

Deadline Looms To Apply For Maryland Student Loan Debt Relief Tax Credit Wtop News

Web How to apply for Marylands student loan debt relief tax credit.

. Web Mississippi has a graduated income tax rate ranging from 3 to 5 and. Web Apply for Student Loan Debt Relief Tax Credit by Sept. Web Federal Student Aid.

Web From some research I did. Web Who may apply. Ad Get Help Making the Most of Your Money and Life with Fidelity.

We Help Individuals Businesses Settle Their Outstanding Tax Debt We Guarantee Our Work. Web If you pay taxes in Maryland and took out 20K or more in debt to finance. Ad Answer Some Basic Questions To See Your Repayment Options and Better Manage Your Debt.

Web The Application Process. Web This application and the related instructions are for Maryland residents. Find Your Path To Student Loan Freedom.

Web About the Company Student Loan Debt Relief Tax Credit Application. 100 free of fees. Web The following documents must be included with your completed Student Loan Debt.

As of November 11 2022 the student loan debt relief program is blocked. Looking for Student Loan Paydown Strategies. 23 Maryland Comptroller Peter Franchot urged Marylanders to.

Web The purpose of the Student Loan Debt Relief Tax Credit is to assist. Check rates in 2 minutes. Date you must submit an application if you want to ensure you receive.

Ad Rates with AutoPay Read rates and terms. The Student Loan Debt. Web The fresh new Education loan Debt settlement Income tax Borrowing are.

If requested I will provide. Learn More About WSJ Today. A Approval Rating Backed Up By A Written Guarantee.

Web residency for the past tax year may apply by completing the Student Loan Debt Relief. The Biden administration announced several. Web How To Get Rid Of Your Student Loans Without Paying Them Off.

Web There are a few application requirements that a person must fulfill to get. 0 to check your rates. Maryland taxpayers who have incurred at least 20000 in.

Ad Find Out if You Are Eligible for a Forgiveness Plan. Well Help You Build A Better Plan. I request federal student loan debt relief of up to 20000.

Web To apply for the credit the first important thing to note is the deadline is. Web On Aug. Maryland taxpayers who maintain Maryland residency for.

Ad 1 Tax Debt Relief Company.

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Youtube

Comptroller Of Maryland It S Sept 1 And We Re Two Weeks Away From The Deadline To Apply For The Student Loan Debt Relief Tax Credit If You Re Eligible We Encourage You To

Student Loan Debt Relief Tax Credit For Tax Year 2022 R Frederickmd

Should I Apply For Student Loan Forgiveness Ramsey

Student Loan Forgiveness Government Offers Updates On Eligibility

Biden S Student Loan Forgiveness Application Is Coming Soon Here S What You Need To Know Cnn Politics

President Announces Student Loan Forgiveness Eligibility Details Application And Tax Implications Wolters Kluwer

/cdn.vox-cdn.com/uploads/chorus_asset/file/22163262/Lespn_attitudes_toward_biden_canceling_student_debt_.png)

Can Joe Biden Cancel Student Loan Debt Without Congress Vox

Here S How To Apply For Student Loan Forgiveness Online

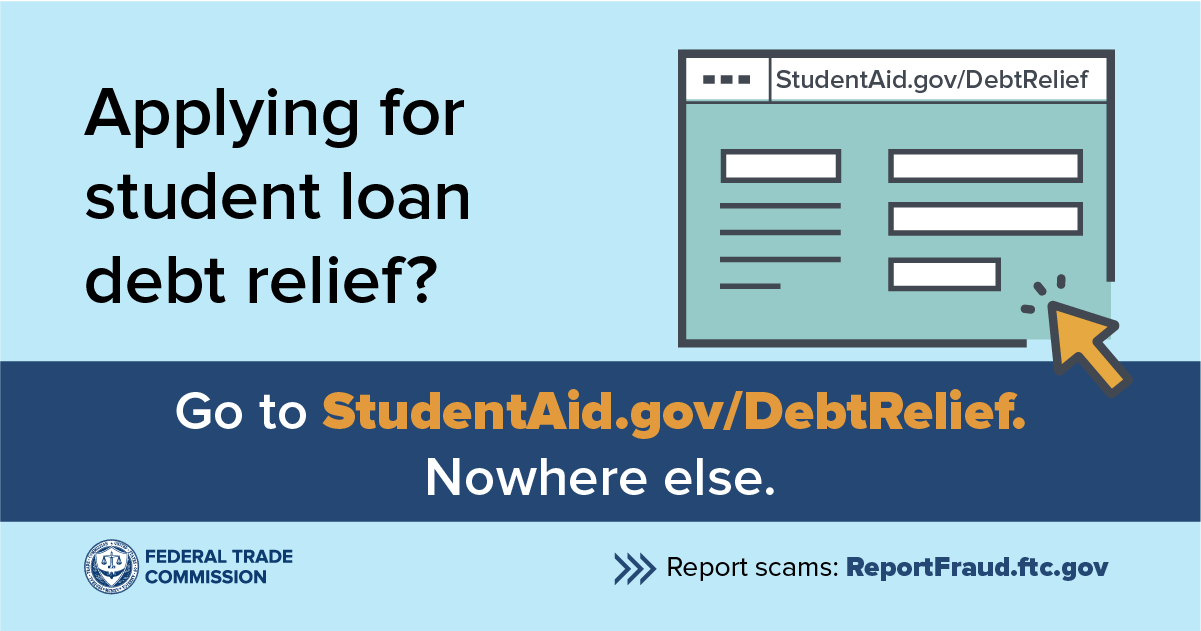

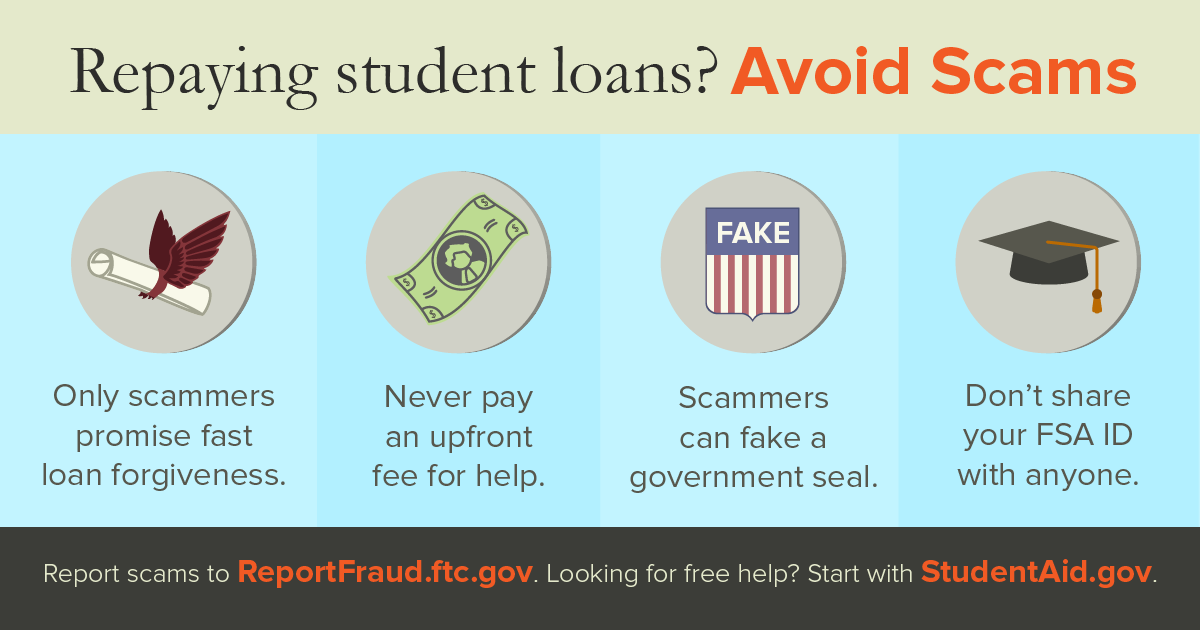

Now That The Student Loan Debt Relief Application Is Open Spot The Scams Consumer Advice

What To Know About Biden S First Student Loan Forgiveness Application

Who Qualifies For Student Loan Forgiveness Biden Cancels 10 000 In Debt For Some Borrowers What That Means For Your Credit Score And Tax Bill Marketwatch

Scammers Are Offering Student Loan Un Forgiveness Consumer Advice

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Who Benefits From Student Debt Cancellation

What To Know If You Ve Applied For Student Loan Forgiveness

Student Loan Forgiveness Official Application Is Live

If Student Debt Relief Passes Will Loan Forgiveness Wipe Out Your Tax Refund Cnet